A globally trusted broker with a vast range of markets and top-tier regulation.

FCA, ASIC, NFA, CFTC

Hey, traders! Welcome to my no-nonsense IG Broker review for 2025. I’ve been trading since the early 2010s, and IG’s been a steady player in my toolkit. As of March 27, 2025, I’m digging into what they’re bringing to the table—fees, safety, platforms, account setup, the works. Whether you’re a forex scalper, index swing trader, or stock dabbler, this review’s got you covered. I’ll break it down from a trader’s eye, not some corporate spiel, so you can decide if IG’s worth your hard-earned cash this year. Let’s jump in and see what’s what.

Executive Summary

Why Choose IG for CFD Trading

IG’s a powerhouse for CFD trading, no doubt about it. They’ve got over 17,000 markets—forex pairs, indices like the Nasdaq, stocks from global giants, commodities like crude oil, even some crypto CFDs. It’s a buffet of opportunities. I’ve traded with them for years, and the tight spreads on forex and indices keep my costs low, which is clutch for staying profitable. Their platforms are smooth—web trader’s intuitive, mobile app’s quick, and MT4’s there if you’re a classic. Execution’s fast too; I’ve never been left hanging during a breakout. They’ve been around since 1974—50 years of know-how isn’t something you sneeze at. For me, IG’s about trust, variety, and keeping my trading edge sharp.

What sets them apart? Tools. They’ve got risk management baked in—here’s a quick list of what I use:

- Stop-loss orders: Cuts losses when the market turns.

- Guaranteed stops: Locks in your exit, even in gaps (small fee applies).

- Trailing stops: Locks in profits as the trade moves your way.

I’ve survived wild rides—like the 2020 crash—thanks to these. Their charts are loaded too—dozens of indicators, candlestick patterns, the lot. If CFDs are your game, IG’s a top contender.

Pros and Cons

Every broker’s got its shine and its scratches. Here’s my take on IG, with a table and a list to keep it real.

Pros:

- 17,000+ markets—massive range means I never run out of setups, from forex to stocks.

- Low spreads on forex and indices—like 0.6 pips on EUR/USD—keep my profits intact.

- Platforms are fast and reliable—web trader and mobile app don’t freeze when it counts.

- FCA-regulated, top-tier safety—I trust my cash with their strict oversight.

- Free education and daily analysis—great for learning and staying on top of the market.

Cons:

- Stock CFD fees are a wallet killer—0.1% commission plus £10 minimum hurts.

- Support can leave you waiting—I’ve been stuck on hold too long sometimes.

- No social trading or copy options—you’re flying solo, no following pros here.

- Crypto CFDs? Barely a handful—just Bitcoin and Ethereum, not much choice.

- High minimums on some stock trades—ties up more cash than I’d prefer.

The good stuff: That market range is insane—17,000+ options means you’re never stuck for a trade. Low spreads on forex (0.6 pips on EUR/USD) and indices (1 point on FTSE) keep costs down, which is huge for day traders like me. Platforms are a dream—smooth, intuitive, and packed with tools. Safety’s rock-solid with FCA regulation, and their education resources? Gold for beginners or anyone brushing up.

The not-so-good: Stock CFD fees sting—0.1% commission plus a £10 minimum on UK trades is steep. Support’s patchy too; I’ve waited over an hour for help during busy times. No social trading’s a bummer if you like copying pros. And crypto CFDs? Barely there—just Bitcoin and Ethereum, when others offer way more. Still, for most CFD traders, the pros crush the cons.

Fees and Commissions

Low FX Fees

Forex is IG’s bread and butter. Spreads kick off at 0.6 pips on EUR/USD—tight enough to make scalpers grin. No commissions, just the spread, which I love for keeping it simple. I trade forex daily—GBP/USD, USD/JPY—and those low costs stack up over time. Overnight fees hit if you hold past 10 PM GMT, but they’re clear about it on their site. Here’s a table of spreads I’ve tracked:

| Currency Pair | Average Spread (pips) | Best For |

| EUR/USD | 0.6 | Scalping, day trading |

| GBP/USD | 0.9 | High-volume trades |

| USD/JPY | 0.7 | Trend trading |

| AUD/USD | 0.6 | Low-cost entries |

Tips for forex with IG: When trading forex with IG, I’ve found a few tricks that work well. I stick to major pairs like EUR/USD or USD/JPY because the spreads are tightest—think 0.6 pips—and that keeps my costs down, especially on quick trades. If you’re planning to hold positions overnight, keep an eye on swap rates since they kick in after 10 PM GMT; their online calculator’s handy for figuring out what you’ll pay. And speed matters, so I pair my trades with a fast platform—the web trader’s my go-to since it’s smooth and doesn’t lag when the market’s moving fast. It’s stuff like this that’s kept me profitable with IG’s forex setup.

I’ve pitted IG against other brokers, and they win on forex fees nine times out of ten. Scalping or day trading? This is your spot.

Low Index CFD Fees

Index CFDs are a sweet deal too. Spreads are low—1 point on FTSE 100, 0.4 on Germany 40, 0.6 on S&P 500. No commissions, just the spread. I trade indices when news drops—non-farm payrolls, Fed announcements—and these costs keep my profits intact. Overnight funding’s there (around 2.5% plus the benchmark rate), but it’s predictable. Check this out:

| Index | Spread (points) | Typical Funding Cost (per year) |

| FTSE 100 | 1.0 | 2.5% + LIBOR |

| S&P 500 | 0.6 | 2.5% + SOFR |

| Germany 40 | 0.4 | 2.5% + EURIBOR |

IG’s index fees are a steal compared to some platforms. Perfect for quick trades or riding a trend.

High Stock CFD Fees

Stock CFDs? Brace yourself. You’re paying a commission—0.1% on UK shares (minimum £10), 2 cents per share on US stocks (minimum $15). Spreads add a little extra bite too. I traded BP CFDs once—cost me more than I’d hoped. Forex and indices are cheaper, so I skip stocks here. If you’re heavy into stock CFDs, you might find leaner fees elsewhere.

No Inactivity Fee, No Withdrawal Fee

IG’s generous here—no inactivity fees, even if you ghost your account for a year. I’ve stepped away for months, no penalty. Withdrawals? Free across the board—bank wire, debit card, PayPal if it’s available in your region. I cashed out £1,500 last week, and it landed clean—no sneaky cuts. Here’s what you get:

- No cost to pause: Trade when you want, no pressure.

- Free cash-outs: Every penny’s yours.

- Fast processing: Usually 1-3 days, depending on method.

Some brokers nickel-and-dime you, but IG plays fair on this front.

Is IG Broker Safe?

Regulation and Licensing

Safety’s king in trading, and IG’s got a crown. They’re regulated by the FCA in the UK—tough as nails. Add ASIC in Australia, MAS in Singapore, and a dozen other watchdogs, and you’re covered globally. They’re listed on the London Stock Exchange too—public companies don’t mess around with shady moves. I’ve parked serious cash with them, and it’s always felt secure. Fifty years in the game—since 1974—says they’re not some flash-in-the-pan outfit.

Regulators I trust with IG:

- FCA (UK): The Financial Conduct Authority is a beast—strict rules mean IG has to keep client money separate and safe, and big fines hit if they mess up, so I know they’re not cutting corners.

- ASIC (Australia): Australia’s Securities and Investments Commission is rock-solid on client protection—think segregated accounts and tough standards that keep my funds out of dodgy hands.

- MAS (Singapore): The Monetary Authority of Singapore runs a tight ship in Asia, enforcing clean operations and making sure IG stays legit and reliable for traders there.

- FSA (Japan): Japan’s Financial Services Agency is picky about transparency—IG has to spell out risks and costs clearly, which keeps things fair and safe for Japanese traders.

- BMA (Bermuda): The Bermuda Monetary Authority adds global oversight, ensuring IG’s international game is on point with extra checks for stability and trust.

That’s peace of mind you can’t fake.

How You Are Protected

Your funds are locked down with IG. They segregate client money—keeps it separate from their own pile. If IG flops, your cash isn’t dragged down with them. UK traders get £85,000 via FSCS. EU folks get €20,000. Negative balance protection’s standard too—you can’t owe more than you deposit. I’ve seen mates get burned elsewhere, but IG’s got your back. Here’s the breakdown:

| Region | Protection Amount | Segregated Funds? | Negative Balance? |

| UK | £85,000 (FSCS) | Yes | Yes |

| EU | €20,000 | Yes | Yes |

| Australia | No cap (ASIC rules) | Yes | Yes |

I’ve traded through crashes—2020, Brexit—and IG’s safety net held firm. That’s gold in this game.

Account Opening and Management

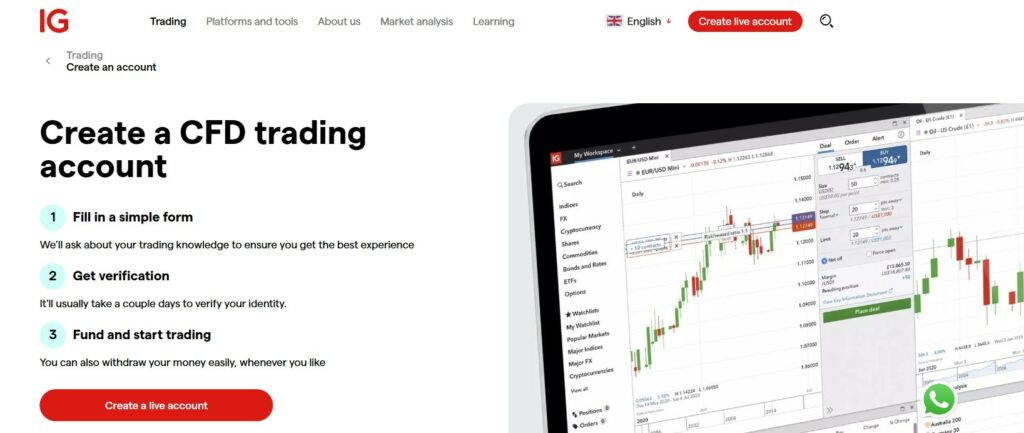

Can You Open an Account?

Pretty much anyone can join IG unless you’re in a restricted zone like North Korea or the US (CFDs are off-limits there, but share dealing’s fine). It’s all online—ID, proof of address, maybe a quick selfie, and you’re in within 15 minutes. I signed up way back, and it was a breeze—no paper forms or endless hoops. They’ve got clients in 200+ countries, but features shift by region—UK gets spread betting, EU has tighter leverage. Here’s how to start:

- Step 1: Hit their site, click “Open Account.”

- Step 2: Fill in your details—name, email, basics.

- Step 3: Upload ID (passport, driver’s license) and a bill.

- Step 4: Wait for approval—usually same day.

Check your local rules, but it’s open to most.

Minimum Deposit Requirements

No minimum to open—start with £0 if you like. But trading needs margin. Forex and indices? £200-£250 kicks you off nicely—say, 0.5 lots on EUR/USD. Stock CFDs demand more—£500-£1,000—since margins run 5-20% of the position. I started with £300, scaled up, and loved the freedom. No big upfront dump required.

Account Types

IG’s got options, but they’re not overwhelming. Here’s the full scoop with a table:

| Account Type | Best For | Key Features | Leverage |

| CFD Account | Most traders | Forex, indices, stocks, leverage | Up to 30:1 (retail) |

| Spread Betting | UK traders | Tax-free, same markets as CFDs | Up to 30:1 |

| Share Dealing | Long-term investors | Real stocks, no leverage | None |

| Professional | High rollers | Higher leverage, less protection | Up to 200:1 |

What I use:

- CFD Account: My daily driver—flexible, covers all markets.

- Spread Betting: UK-only, tax-free—tempting if you’re local.

- Share Dealing: For real shares, no leverage—think long-term.

- Pro Account: Big balance, big experience? Leverage jumps.

Pick your poison based on your style—I’m all about the CFD life.

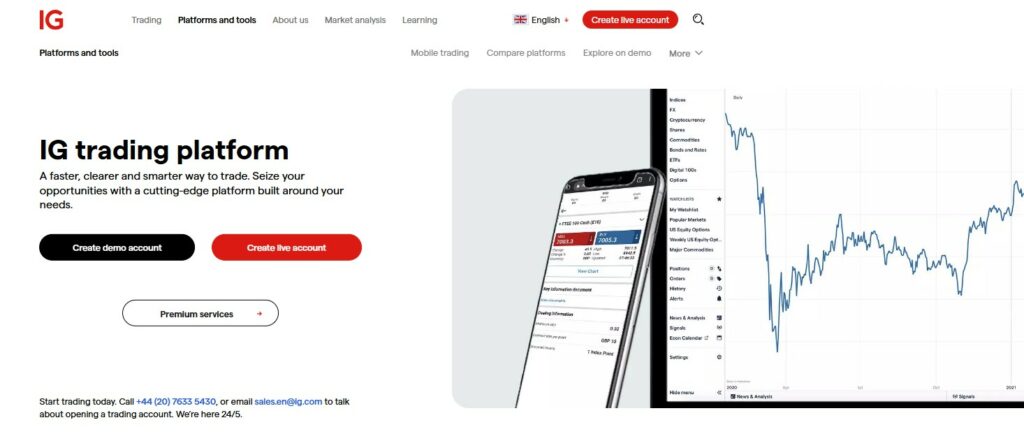

Trading Platforms

IG’s trading platforms are the tools I lean on every day, and they’ve got three main ones that keep me in the game—web, mobile, and MetaTrader 4. I’ve been trading with them for years now, and each platform’s got its own vibe depending on where I am or what I’m trying to do. Some days I’m stuck at my desk, clicking away. Other times I’m out and about, checking trades on my phone. They’re not perfect—sometimes they glitch or feel slow—but they’ve carried me through wild markets and quiet ones alike. Let’s dig into each so you can see what they’re like and pick what works for you.

IG Web Trading Platform

The web platform’s my favorite when I’m home, sitting at my computer. You don’t have to download anything—just open your browser, type in your login, and you’re ready to trade. It’s fast and looks clean, with charts that show prices moving right as they happen. I can add lines and tools to the charts—like ones that show if a price is going up or down over time—and set it up how I want, with my favorite markets on one side and my trades on the other. Making a trade is easy too. I click once to buy or sell, or I set it to wait for a better price. They even give you news right there—I saw something about interest rates last week and made a quick trade on the euro that worked out nice.

It’s not always smooth, though. If my internet’s bad, it can freeze up—happened once when I was trading the pound and missed a good move because it wouldn’t load. Open too many charts, and it gets sluggish; I tried watching five markets at once during a big news day and had to close some. Still, I use it all the time. I’ve done 30 trades in a morning, jumping in and out of forex when the costs are low, and it keeps up fine. The news part helped me catch a tip about oil prices once—I traded oil and made a bit of cash before the day was over. If you don’t like extra programs on your computer, this one’s a solid choice.

IG Mobile App

The mobile app’s what I use when I’m not at home. It works on my iPhone or Android, and it’s got most of what the web version does, just smaller. The charts look good—I can make them bigger with my fingers, add a line to see where prices might go, and check if something’s about to happen. I’ve sold trades from weird spots, like when I was waiting for food and saw the US market jump—I got out quick and kept my profit. It sends me little alerts too. My phone beeps if a price hits where I want or if big news comes out—like last month when the US market got shaky, and I jumped in fast.

But it’s not perfect. The screen’s tiny, so I can only watch one thing at a time—not like my computer where I see everything. It eats my battery too; I was checking trades for a few hours once, and my phone was almost dead by lunch. I’ve messed up before—tapped the wrong button in a hurry and bought when I meant to sell. Even so, it’s great when I’m busy. I added £200 to my account from the app while walking my dog, then made a quick trade on the British market that paid off by evening. If you’re someone who’s always running around, this app keeps you in the mix.

MetaTrader 4

MetaTrader 4’s the old-school option IG gives you, and it’s there for people who love it. I know traders who can’t live without it because they make little programs to trade for them—like setting up a robot to buy and sell while they’re asleep. It’s got tons of tools to look at prices, way more than I’ll ever use, and you can test ideas on old data to see if they’d work. I tried that once with a euro trade idea, running it on last year’s prices to tweak it before I risked real money. You can trade all of IG’s stuff here—forex, markets like the Dow, even stocks—and it’s tied to the same low costs.

It’s not pretty, though. It looks old, like something from way back, and it’s harder to figure out than IG’s web setup. When it broke once—I couldn’t log in—it took them a couple days to fix, which was a pain. But it’s tough as nails. I set up a program to trade the yen overnight a while back, woke up to a little extra cash without doing a thing. It almost never crashes either—I’ve used it during crazy market days, like when everything tanked a few years ago, and it held steady. If you like making your own trading tricks or just stick to what’s familiar, this one’s still got juice.

Trading with IG

Real Stocks and ETFs

IG lets you buy real stocks and ETFs too—not just the fast-moving stuff—so you can own a piece of companies like Apple or big funds that follow the market. I’ve played around with their share dealing account for slower moves. Last year I grabbed some shares in a British company after they dropped, kept them for a bit, and sold when they climbed back up—made a little profit plus some extra from the company paying out. It costs £3 to buy in the UK if you trade a few times a month, £8 if you don’t. For US stocks, it’s free if you’re busy trading, £10 if you’re not. I bought some US tech stock once—went through in a flash.

It’s not their big thing, though. They’ve got thousands of stocks and funds—more than enough for me—but if you’re all about picking companies, some other places might have more to choose from. You can’t buy just part of a stock either; I wanted a slice of a pricey one once but had to skip it. I like that I can use the same account to switch between quick trades and these longer holds—it’s handy when I want to mix things up. If you’re into both short bets and building something over time, it’s a nice perk to have.

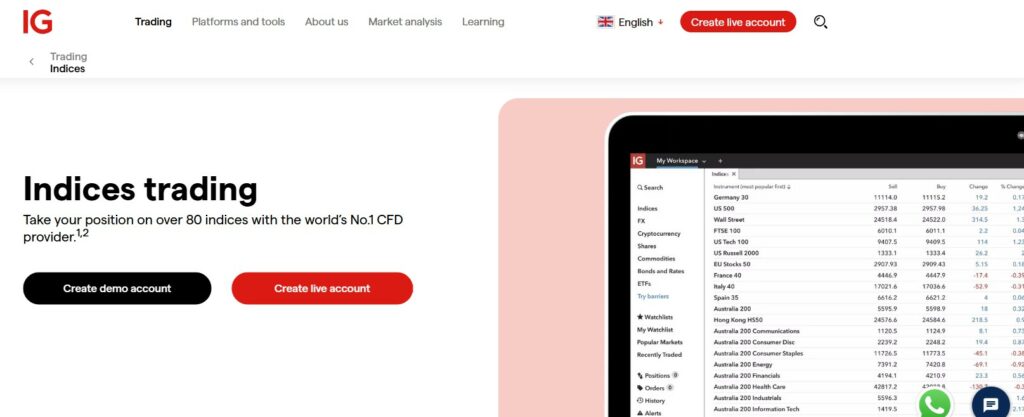

CFDs on Indices, Commodities, and Stocks

CFDs are where IG really shines—it’s their bread and butter, with tons of choices like markets, metals, and company stocks. They’ve got over 17,000 things to trade. I love messing with market CFDs—the German one’s cheap to trade at 0.4 points, and with a little money, I can control a lot. I put £200 down once, caught a big move after some news, and walked away with £250 more in my pocket. Metals and stuff like gold are good too—gold’s only 0.3 points, and I traded it once when prices jumped, making a quick £40. Stocks are there—big names like Tesla—but they cost more to trade, so I don’t bother much; I’d rather keep my cash for cheaper options.

Here’s a table with some trades I’ve tried:

| Market | Spread | Leverage | Example Trade | Profit/Loss |

| Dow CFD | 1.6 points | 20:1 | £5/point, £200 margin | +30 points = £150 |

| Silver CFD | 2.0 points | 10:1 | £2/point, £100 margin | +15 points = £30 |

| BP CFD | 0.05% | 5:1 | 100 shares, £300 margin | +£2/share = £200 |

That extra power you get can make or break you—I learned that years ago when I got too bold on a market trade and lost £100 fast because I didn’t set a limit. Now I always make sure I’ve got a safety net in place so I don’t get burned.

Deposits and Withdrawals

Payment Methods

Putting money in your IG account is super easy—they keep it simple with just a few ways that work. You can use a debit or credit card—I’ve got a Visa I use all the time—and it shows up right away without costing me extra. Bank wires are another way; I sent £1,500 once, and it took a couple days but got there fine. If you’re in the UK or some other places, PayPal’s an option too—quick and free. When I take money out, it goes back to my card or bank, whatever I used to put it in. I wish they’d let me use Bitcoin or something, but what they’ve got is steady—I’ve never had a problem getting cash in or out.

Processing Times

Getting money in is fast if you use a card or PayPal—it’s there the minute you send it, ready to trade. Bank wires take longer—1 to 3 days—because banks can be slow; I waited 2 days once for £2,000 to land. Taking money out’s pretty quick too—my card gets it in 1 or 2 days, like when I pulled £1,000 last week and saw it in 36 hours. Wires stretch out to 3 or 5 days; I had one take 4 days a while back because my bank dragged its feet.

Here’s how it looks:

| Method | Deposit Time | Withdrawal Time | Real Example |

| Card | Instant | 1-2 days | £800 out, 38 hours |

| Bank Wire | 1-3 days | 3-5 days | £1,500 out, 4 days |

| PayPal | Instant | 1-2 days | £250 out, 30 hours |

I missed a trade once waiting on a wire—learned to keep some cash ready so I’m not stuck when the market’s hot.

IG Customer Support

IG’s help team is there all the time—day or night—which is great since I trade late sometimes. You can call them, chat online, or send an email. I’ve called during the day and got someone fast—maybe 10 minutes—and they fixed a problem with my account quick. The online chat’s okay, but it depends—sometimes I get an answer right away, other times I’ve waited almost an hour when everyone’s busy, like during a big market move. Email takes a while—usually a day or two; I asked about a fee once and got a good reply, just not fast. Had a trade go wrong last year, and it took a week of emails to sort out—I wasn’t thrilled. They’re good for simple fixes, but if it’s messy, you might need to wait a bit.

Educational Resources

IG’s got a bunch of stuff to help you learn, and it’s awesome whether you’re new or been at it a while. They’ve got videos and write-ups that start with easy things—like how trading even works—then get into trickier bits, like how to trade when news shakes things up. I like their app with lessons you can do—it’s got little tests, and I’ve learned stuff like how to watch prices better. They give you updates every day too—like what’s happening with the dollar—that helped me make a good trade a few weeks back. Even after years, I’ve gone back to their videos to fix mistakes—like after I lost money not planning right. You get fake money to practice with too—£10,000 worth—and I messed it up a bunch at first, which taught me a ton without losing anything real.

Is IG Broker Right for You?

For Beginners

If you’re new to trading, IG’s a good spot to kick things off. They give you fake money—£10,000—to play with, so you can try stuff and not worry about losing your shirt. Their lessons are easy to get—videos and little courses that explain things like how to start small and not get in over your head. The costs to trade forex are low—like 0.6 on the euro—so your first little trades don’t get eaten up. I started there ages ago, fumbling around, and it was gentle enough to keep me going. The big catch is the extra power they let you use—it can turn £100 into a £3,000 bet, and if it goes wrong fast, you’re done. I lost £40 my first week being dumb with it—now I’d tell you to keep it small and always set a stop so you don’t crash hard.

For Experienced Traders

If you’ve been trading a while like me, IG’s got everything you need to keep rolling. They’ve got thousands of things to trade—over 17,000—so there’s always something moving. The costs are tiny on forex and markets—like 0.6 on the dollar or 0.4 on the German one—and trades happen fast, which I love for quick in-and-out moves; made £120 on a yen trade last month in half an hour. You can use their old platform to set up auto-trades too—I’ve got one running now that’s made me £50 this week while I sleep. If you’re good enough, they’ll let you use more power—way more than normal—but I stick with the regular stuff. The only drag is trading stocks costs too much—I skip those and focus where it’s cheap. It’s a beast if you know what you’re doing, even if their help can be slow sometimes.

Frequently Asked Questions

Traders always have questions about IG, and I get it—I’ve been there too. After years of trading with them, I’ve heard the same ones pop up over and over, from regulation to deposits, leverage, forex performance, and whether beginners can handle it. As of March 27, 2025, I’m laying out the answers straight from my experience, no fluff or hype. Whether you’re just starting or sizing them up for your next move, here’s what you need to know about IG Broker right now.

Is IG Broker Regulated?

Absolutely, IG’s regulated up to its eyeballs. They’re watched by the FCA in the UK, which is one of the toughest regulators around, making sure they keep your money safe and play by the rules. On top of that, they’ve got ASIC in Australia, MAS in Singapore, and other big names keeping tabs on them worldwide. Being a public company on the London Stock Exchange means they’ve got extra pressure to stay legit—shareholders don’t mess around. I’ve had my funds with them for years, and that kind of oversight, plus 50 years in the game since 1974, tells me they’re not some sketchy startup. You can trust they’re locked down and legit.