Plus500 is a beginner-friendly broker offering a user-friendly platform and a wide range of instruments.

FCA, ASIC, JFSA, FMA, MAS, CySEC, other regulators

Hey traders, welcome to my deep dive into Plus500 for 2025! I’ve been trading for years—seen the good, the bad, and the ugly—and I’m here to give you the straight scoop on this platform. We’re talking tools, costs, ease of use, and whether it’s worth your time. Newbie or pro, I’ve got insights to help you decide if Plus500 fits your trading game in 2025. Let’s break it down and see what’s what.

Plus500 Core Essentials – What You Need to Know

Before we dig into the details, let’s get the basics locked in. You need to know what Plus500 is, where it’s been, and if you can trust it with your hard-earned cash. I’ve traded on dozens of platforms—some great, some disasters—so I’ll lay it out plain and simple based on what I’ve seen.

What is Plus500? Company Profile and History

Plus500 started back in 2008, born in Israel with a mission to make trading accessible. They’re a CFD broker—Contracts for Difference—which means you’re speculating on price swings for stuff like forex, stocks, crypto, and commodities without actually owning them. It’s a slick way to trade if you like flexibility. They hit a milestone in 2018, going public on the London Stock Exchange, and that’s no small feat—it shows they’re playing the long game. Today, they’ve got millions of users worldwide, offices in places like the UK and Australia, and they’ve even rolled out futures trading for U.S. clients in recent years. I remember when they were just a scrappy startup; now they’re a global player. Regulated in multiple countries, they’ve built a rep for sticking around and keeping things legit.

Here’s a quick timeline of their journey:

- 2008: Launched in Israel, focused on CFD trading.

- 2013: Expanded into mobile trading with their app.

- 2018: Went public on the London Stock Exchange (LSE: PLUS).

- 2023: Added futures for U.S. traders, broadening their reach.

- 2025: Still growing, with a solid user base and tight regulations.

For me, their history says stability. They’re not some overnight operation—they’ve got roots and a track record I can respect.

Is Plus500 Legit?

Alright, let’s tackle the big question: can you trust Plus500? In a word, yes. They’re regulated by some of the toughest watchdogs out there—the UK’s FCA, Australia’s ASIC, Cyprus’s CySEC, and more. These aren’t lightweight regulators; they enforce rules like segregating client funds, so your money isn’t mixed with the company’s. That’s a safety net I always look for. Since going public, they’ve stayed clean—no major blowups or shady moves I’ve heard about. I’ve traded with them on and off, and my funds have always been safe. Are there complaints online? Sure, every broker has some. But nothing I’ve seen raises red flags. They’re solid, not perfect—but solid’s what counts.

Here’s what makes them legit in my book:

- Regulation: FCA, ASIC, CySEC—big names backing them.

- Segregated Funds: Your cash stays separate, safe from their business risks.

- Public Listing: Answerable to shareholders, not just themselves.

- No Major Scandals: A clean slate since 2018.

If you’re wondering whether to trust them, I’d say they’ve earned it.

Plus500 Trading Experience

Now, let’s get to the meat of it—what’s it like to trade on Plus500? The platform you use every day can make or break your trades, so I’ve put their tools through the paces. Here’s the full rundown.

WebTrader Platform

The WebTrader is Plus500’s custom-built platform, and it’s a breath of fresh air if you hate clutter. No software downloads—just log into their site, and you’re in business. The layout’s simple: real-time charts, a watchlist, and trade buttons all front and center. I’ve used it to scalp EUR/USD, and the execution’s fast—no lag when I need to jump in or out. You get handy tools like price alerts and a trader sentiment gauge—shows you what percentage of users are long or short. That’s clutch for gauging market vibes. Last week, I set an alert on oil and caught a $2 move—worked like a charm.

But it’s not all roses. If you’re into heavy technical analysis, the charting’s basic—think moving averages and RSI, but no Fibonacci or custom indicators. And forget linking it to MetaTrader or TradingView. For me, it’s ideal for quick, manual trades. If you’re a set-and-forget type, it’s plenty.

Plus500 Mobile App

The mobile app is a trader’s best friend when you’re not glued to a desk. It’s on iOS and Android, and it packs everything the WebTrader has—charts, trades, even account funding. I’ve used it on my iPhone during a coffee run, placing a trade on gold while the line moved. It’s smooth, fast, and hasn’t crashed on me yet, even with dodgy Wi-Fi. You can deposit or withdraw right from the app too, which saved me when I needed quick cash last month. The catch? No two-factor authentication, which feels like a miss in 2025—I’d sleep better with that extra lock. Still, it’s a reliable tool I lean on daily.

Download Options for Different Devices

Plus500 doesn’t mess around with downloads—it’s streamlined. There’s no desktop app; the WebTrader runs on any browser—Chrome, Firefox, Safari, you name it. I’ve used it on my Windows laptop and my old MacBook, no hiccups. The mobile app’s your only download, available for iOS and Android. No bells and whistles like a smartwatch app or Linux version. It suits me fine—I bounce between my phone and laptop, and it’s seamless. If you’re tied to a niche device or want a standalone program, you might feel boxed in. For most traders, though, this setup’s practical and fuss-free.

Plus500 Account Types and Access

Getting started with Plus500 is easy, and they’ve got options for every level. I’ll walk you through the accounts and how to manage them—plenty to unpack here.

Demo Account

The demo account is pure gold, especially if you’re testing the waters. You start with a virtual pile—around $40,000—and trade in real-time market conditions. I’ve used it to experiment with max leverage on crypto, stuff I’d never risk with real cash. It’s unlimited—blow it up, reset, and go again. For newbies, it’s a stress-free way to learn without losing your shirt. I still hop in sometimes to test a new forex strategy—last month, I practiced a breakout play on GBP/JPY and nailed it live later. It’s as real as it gets, minus the wallet hit.

Real Account Setup Process

Setting up a real account takes maybe 10 minutes if you’re prepared. Sign up with your email and password—or link Google/Apple for speed—then verify your identity. I uploaded my driver’s license and a power bill; approval came in 24 hours. Next, you deposit, and you’re trading. Don’t skip verification—unverified accounts can’t trade or cash out, and I’ve seen mates get stuck there. Pro tip: snap clear pics of your docs to avoid back-and-forth. It’s simple, but you’ve got to follow through.

Plus500 Login

Logging in is dead easy. Hit the site or app, punch in your email and password, and you’re good. No captchas or extra steps—I’m in within seconds. I love that speed when markets are moving. The downside? No two-factor authentication, so a stolen password could spell trouble. I’ve had no issues, but I keep mine locked tight. It’s built for convenience, and it delivers.

Account Management and Customization

Once you’re in, managing your account is a breeze. You can tweak your profile, set alerts, and switch between demo and real modes instantly. I’ve got alerts on USD/CAD that ping me when it’s go-time. You can track trades, profits, and losses live—great for keeping tabs. Customization’s lighter than I’d like—you can’t change the platform’s look or base currency without emailing support, which feels clunky. Still, it’s functional. I’m there to trade, not redecorate, so it works for me.

Understanding Plus500 Costs and Fees

Costs can sneak up on you, so let’s lay out Plus500’s fees. They’re transparent, which I respect, but you need the full picture. Here’s a detailed table:

| Fee Type | Details | Trader Insight |

| Spreads | Varies (e.g., 0.8 pips EUR/USD) | Decent, but not razor-thin—check competitors |

| Overnight Funding | Charged for positions held overnight | High if you swing trade—plan accordingly |

| Inactivity Fee | $10/month after 3 months idle | No biggie—just log in now and then |

| Currency Conversion Fee | Up to 0.7% for non-base currency | Adds up if you trade exotic pairs |

| Deposit/Withdrawal Fees | None—free transactions | A huge win—keeps more cash in play |

Spreads are how Plus500 profits—no flat commissions. On EUR/USD, 0.8 pips is workable, but I’ve seen tighter elsewhere. Overnight fees hit hard if you hold past the cutoff—I got burned leaving a stock CFD open too long. Day trading keeps that in check. The inactivity fee’s avoidable—just log in quarterly. No deposit or withdrawal fees is a standout—every dollar stays yours. It’s a setup that favors active, short-term traders like me.

Deposit and Withdrawal Process

Moving money is make-or-break for any broker. I’ve tested Plus500’s system—here’s how it shakes out.

Plus500 Minimum Deposit Requirements

You need $100 to start with a card or e-wallet—PayPal, Skrill, whatever. Bank transfers jump to $500, which feels hefty but isn’t rare. I kicked off with $100, enough to trade forex and dabble in indices. It’s not the cheapest—some brokers take $10—but it’s reasonable for a serious platform. If you’re just testing, the demo’s free anyway.

Payment Methods and Processing Times

They’ve got a solid lineup:

- Credit/Debit Cards: Visa, MasterCard—instant deposits.

- E-Wallets: PayPal, Skrill—same-day funding.

- Bank Transfers: 2-5 days, slower but secure.

Deposits with cards or e-wallets hit instantly—I’ve funded mid-session and traded seconds later. Bank transfers lag, but that’s normal. Withdrawals take 1-3 days; my last card pull took two, no fees. You’re locked to withdrawing via your deposit method—PayPal in, PayPal out. It’s a security thing, and I’m fine with it. Fast, free, and reliable.

Plus500 Trading Capabilities

This section is about what you can trade and how Plus500 makes it happen. I’ve spent loads of time messing around with their setup, testing what works. It’s got the goods—assets to pick from, leverage to play with, and orders to get in and out. Here’s everything you need to know to hit the ground running.

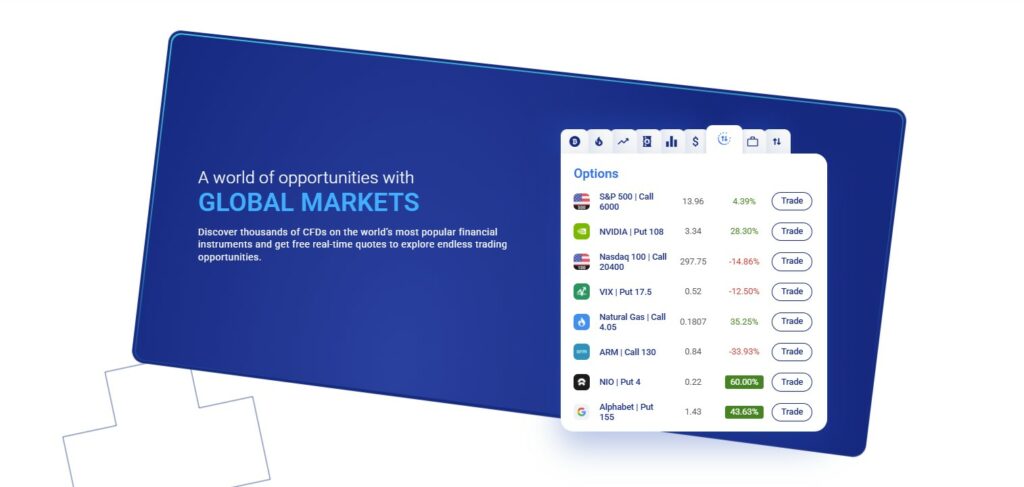

Available Assets and Markets

Plus500 gives you over 2,800 things to trade, which is a lot! You can go for forex pairs like EUR/USD or USD/JPY, stocks like Amazon or Google, and indices like the Dow Jones. They’ve got commodities too—oil, gold, even sugar if you’re into that. Crypto’s on the list—Bitcoin and Ethereum mostly, depending on where you live. For U.S. traders, they’ve added futures on stuff like gold or the S&P 500, which mixes it up. I’ve traded forex and a few tech stocks here, and I like having options. It’s not every market under the sun, but it’s more than enough for most people unless you’re hunting rare stuff.

Leverage Options and Restrictions

Leverage is borrowing power to trade bigger than your cash. On Plus500, regular traders in places like the UK get up to 1:30—so $100 moves $3,000 worth of stuff. Pros can crank it to 1:300 if they pass some checks, but that’s a wild ride. Forex pairs usually hit 1:30, stocks might be 1:5, and crypto’s tight at 1:2 because it’s so jumpy. I’ve used 1:20 on GBP/USD, and it’s a nice boost without losing my shirt too fast. In the U.S., futures use margin instead—low during the day, higher overnight. You’re protected from losing more than you put in, which I love. Once, a bad trade didn’t sink me thanks to that. Look at each asset’s “Info” tab—it shows your limits clear as day.

Order Types and Execution Quality

Orders tell Plus500 when to buy or sell for you. It’s pretty basic: market orders go instant, and limit or stop orders wait for your price. They’ve got a guaranteed stop-loss too—it locks your max loss, even if the market goes nuts, though it bumps the cost a little. I’ve used it on oil trades when prices were all over, and it’s a lifesaver. No trailing stops or tricky setups, which bugs me when I want more control. Execution is snappy, though. My forex trades fly through, even during busy times like news drops. I’ve never had a trade lag and cost me cash. It’s built for quick moves—day traders will like it, but super-speed scalpers might feel held back.

Plus500 No Deposit Bonus and Promotions

Who doesn’t want a bonus? Plus500 has some offers, but don’t get your hopes up for free money with no deposit. I’ve kept an eye on their deals over time, and they’re more about nudging you to trade. Here’s a table with what’s going on in 2025.

| Promotion Type | Details | Conditions | My Thoughts |

| Welcome Bonus (U.S.) | Up to $200 in free trades | Deposit $200+, U.S. futures only | Sweet deal for U.S. folks |

| Deposit Bonus (CFD) | Maybe $50 if you add $500 | Deposit and trade a set amount | Gives you a little extra |

| Referral Bonus | Cash for bringing friends | They need to deposit and trade | Cool if you’ve got trader pals |

| No Deposit Bonus | Nothing right now | None | Too bad, but not a must-have |

The U.S. futures bonus stands out—drop $200, get $200 in trades for free. For CFD accounts, you might score a bit extra with a deposit, but you’ve got to trade to cash it in. I got a $30 bonus once after funding—it’s nice, not huge. Referral cash is real if your friends join up. No deposit bonus? Nope, not now. Offers change, so peek at their site sometimes.

Plus500 Trading for Different Strategies

Can Plus500 match how you like to trade? I’ve tried all sorts of ways here, and it’s better for some than others. Here’s a list breaking it down:

- Day Trading: Awesome for this—trades happen fast, costs stay low, and the app lets me trade from anywhere. I’ve flipped USD/CAD in a day and walked away happy.

- Swing Trading: It’s decent. You can hold trades a few days, but watch those overnight fees—they add up quick. I keep swings short to dodge that.

- Scalping: Not the best. Tools aren’t fast enough for tiny, rapid trades. I’ve scalped EUR/USD, but it’s clunky compared to other platforms.

- Long-Term Trading: Tough one. Holding CFDs long-term gets expensive with fees—better for quick ins and outs than years-long bets.

- Hedging: Pretty good. I’ve paired stock CFDs with forex to cut risks, and it’s smooth—like balancing oil with a futures trade last month.

It’s a winner for fast, active trading. Slow traders or robot fans might not love it as much.

Educational Resources and Support

Plus500 helps you figure things out and fixes stuff when you’re stuck. Their Trading Academy has videos, articles, and tips—like how to trade or avoid big losses. I watched a video on setting stops, and it was short and clear, perfect for newbies. The demo account ties in—you practice with fake money and learn hands-on. Support’s there all day, every day—chat, WhatsApp, or email. I had a deposit question once, hit up chat, and got an answer in five minutes flat. No phone option, but they’re quick and helpful anyway.

Advanced Plus500 Topics

This is for traders who want the deeper stuff. It’s extra info that kicks in when you’re ready to level up.

Plus500 Affiliate Program

You can make money by spreading the word about Plus500. Their affiliate program pays—sometimes $200 or more—when someone signs up, adds cash, and trades. I’ve got a buddy who does this with a trading blog, and it’s a nice side gig. They give you links, banners, and a dashboard to track it. How much you earn depends on where your referrals are and how much they trade. If you’ve got an audience, it’s a no-brainer.

Corporate Actions and Dividend Handling

Trading stock CFDs means dealing with company moves. If you’re long on a stock like Microsoft and it pays a dividend, you get a little cash added—I scored $12 once. Short it, and you owe that amount instead. Stock splits tweak your position size and price automatically, no sweat. I’ve had it happen on a tech stock, and it adjusted fine. Always check the asset’s “Info” tab—keeps you ahead of surprises.

Is Plus500 Right for You?

Should you jump on Plus500? If you’re starting out, it’s super simple—easy tools, a free demo, and a low $100 start. I use it for quick trades and love the asset choices. Costs are okay—spreads are fair—but holding trades overnight can get pricey. It’s great for basic CFD trading with no headaches. If you want real stocks or fancy setups, it’s not your fit. Think about what you do in the markets, and you’ll see if it clicks.

The Verdict: Plus500’s Place in the Trading World

Plus500 holds strong in 2025 for easy CFD trading. It’s not loaded with extras—no big bonuses or crazy tools—but it’s fast, safe, and gives you lots to trade. Big names like the FCA keep it legit, and the U.S. futures option shows they’re growing. I’ve turned profits here, and so have tons of others. It’s not the top dog for everyone, but it’s a reliable choice in the trading pack.

Frequently Asked Questions

Got questions about Plus500? I’ve traded on this platform plenty, so I’ll break it down for you. These are the things people ask most, answered in a way that makes sense whether you’re new or experienced.

What is Plus500’s minimum deposit?

The minimum deposit at Plus500 is $100 if you use a card or e-wallet like PayPal. That’s what I started with—it’s enough to test the waters without feeling broke. For bank transfers, it jumps to $500, which feels a bit steep but isn’t unusual. It depends on how you fund your account and where you’re from. U.S. futures traders might see $200 as the starting line for some bonuses. Low entry, simple rules—works for most.